SaaS Loan Lifecycle Management System

A single integrated loan lifecycle management system to meet all your needs. Biz Core’s SaaS loan management solutions will support you through every stage of the digital lending journey. Get started with competitive onboarding costs!

✔️Low Set Up Fees ✔️Simple & Intuitive ✔️Local Aussie Support

Table of contents

Online Loan Lifecycle Management System

An online loan lifecycle management system can help your lending business in numerous ways. Transform digitally, upscale your operations, optimise efficiency, eliminate human error and manual processing delays, and wave goodbye to messy and outdated Excel spreadsheets. Use Biz Core lending software to manage and automate the entire loan lifecycle, from origination to payments processing, in one single secure system.

Process Loans Faster

A cloud-based loan lifecycle management system is the key to processing loans faster and expediting business growth. With enhanced decision-making capabilities, your business will be able to meet higher benchmarks.

Offer your customers an even better lending experience by digitising the whole loan process. You’ll be able to cut out unnecessary data entry and admin work, reduce service time, and implement workflow automation.

Onboard clients faster with a digital loan management system (LMS) and benefit from:

- Electronic signatures

- Bank statements

- Unlimited cloud storage

- Automated alerts and reminders

- Risk ratings

- Integration with 3rd party credit bureaus

- Underwriting

- Regulatory compliance

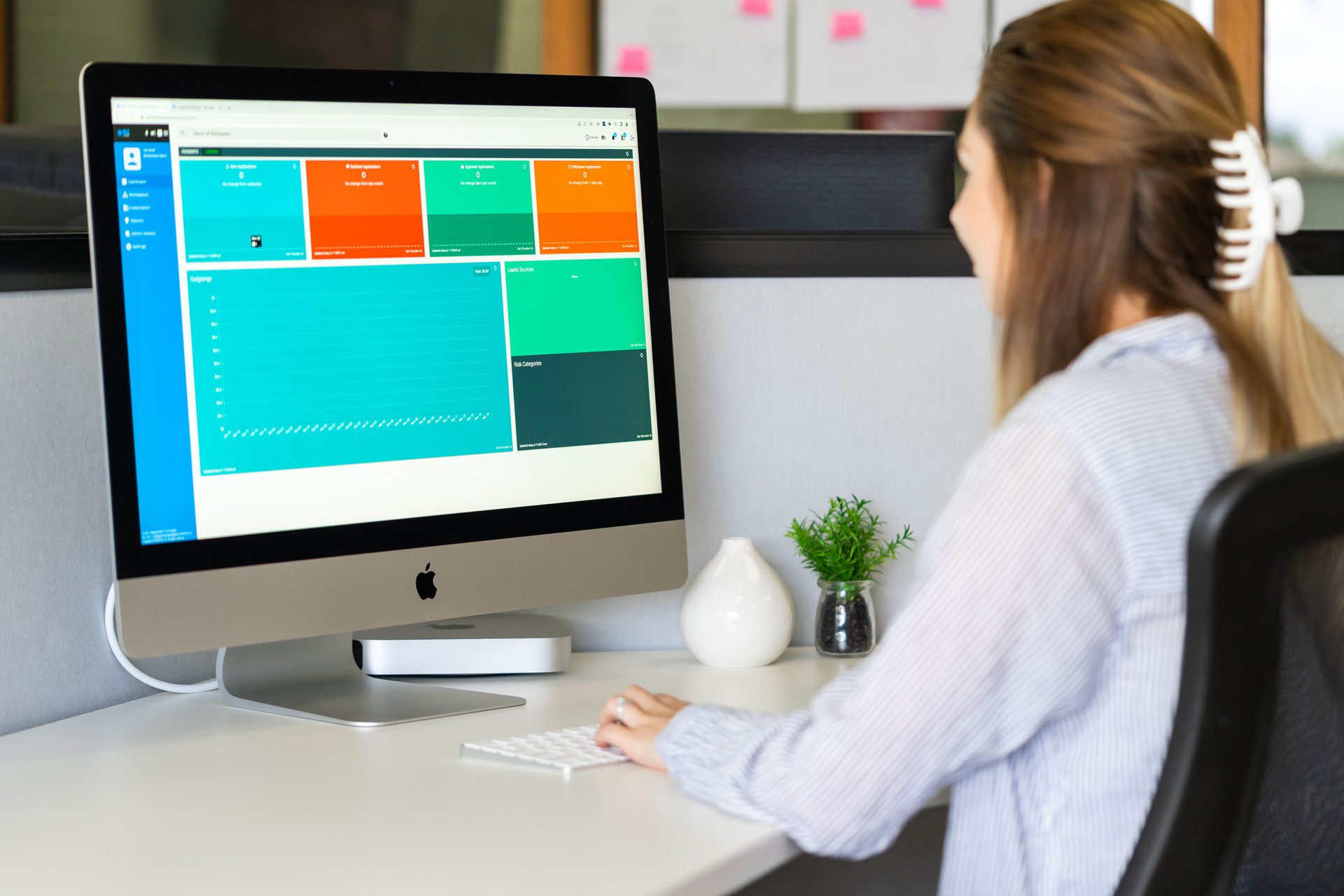

360° Loan Lifecycle View

360° Loan Lifecycle View

The best thing about a complete loan lifecycle management platform is how easy it is to stay in control. You can keep track of your customers and manage your loan book every step of the way.

Biz Core’s LMS gives you a real-time data dashboard, daily reports, and easy access to records at any time. And with cash flow data to hand when you need it, you can plan for the future.

Loan Servicing Tools

From acquisition to completion, get started on the right track and then stay on it with Biz Core’s complete loan lifecycle management system.

Loan servicing features included in Biz Core’s all-in-one loan lifecycle management platform:

- Collateral management

- Reporting

- Automated payments

- Portfolio management

- Customer records

- Digital statements

- Collections and write-offs

- Refinancing

Instead of juggling different systems to meet all your business and regulatory requirement needs, you can stay inside one workspace.

Keep Your Data Secure

Outdated security software poses a big risk to you and your customers. That’s why it’s essential to invest in loan management software with a robust security infrastructure.

You can enjoy the comfort of knowing your data is secure with Biz Core’s state-of-the-art Microsoft Azure cloud security. It uses real-time global security intelligence to quickly detect threats and safeguard your data.

Book a demo

"*" indicates required fields

Why Use Biz Core Loan Lifecycle Management System

Increase Customer Satisfaction

Make your customers happy with easy application processing.

Paperwork becomes stress-free when you can upload and sign documents from any device, anywhere.

Total Security

Thanks to state-of-the-art Azure cloud security, the system and all your data is and always will be safe and sound.

Maximum Efficiency

With a seamless and automated process to follow, you don’t have to worry about data entry mistakes and other human errors. Every stage of the lending process is tracked, leaving behind a clear and simple audit trail.

Data Visualisation & Daily Reports

Track your daily applications, transactions, and leads, and view your monthly revenue all on the same page.

Improve Organisation & Consistency

With a built-in workflow process, your staff and clients can rely on an efficient, pain-free application assessment and approval process.

Payment Automation

Never worry about payments again with scheduled direct debits. Track successful and failed payments, and set automatic notifications and reminders.

More Than Just Loan Lifecycle Management Software

Our client-centred approach means that our lending software has been built around your needs and the needs of your customers. Easy to use and ready to be tailored to your specific needs, Biz Core is more than just your trusted loan lifecycle management tool. An end-to-end lending solution, discover how else our platform can help your business reach new heights.

Loan Book Management

Our simple and intuitive system makes loan book management easy. Single-point customer records, payment automation, and cash flow visualisation are just the beginning.

Learn more: Loan Book Management

Loan Servicing

Streamline the loan servicing process and keep things running smoothly. Our loan servicing features are built to save you time, money, and effort.

Learn more: Loan Servicing Solutions

Loan Origination

Get customers onboarded faster with fast processing, unlimited cloud storage, e-signatures, automation, and more.

Learn more: Loan Origination System

Business solutions

A complete loan management system to service your specific finance business needs.

Learn more: Loan Management Business Solutions

Loan lifecycle Management System FAQs

View all FAQsWhat is a loan life cycle?

The term “loan life cycle” refers to the journey of a loan. This begins from when a borrower submits their application to when the loan is repaid in full with interest. There are varying stages that make up the loan life cycle and it can differ between lenders. However, generally, the stages of a loan life cycle include:

Step 1 - A customer submits their application for a loan to the lender.

Step 2 - The lender appraises the application and assesses the eligibility of the applicant.

Step 3 - If the loan application is successful, a contract or terms and conditions will be sent to the customer to be signed.

Step 4 - Once a signed contract is in place, the funds will be dispersed to the customer.

Step 5 – Customer begins repaying the loan, with interest, in the agreed scheduled instalments.

Step 6 – Customer pays the last instalment, and the loan is settled. Any collateral will be lifted or returned during this stage.

What is a loan management system (LMS)?

An LMS is a digital solution for lenders that moves every phase of the loan lifecycle onto a simple online platform. A LMS helps to automate your business processes from loan origination to loan servicing to reporting. It’s particularly useful for small businesses looking to move from a paper-based or excel-based loan book into an integrated online environment.