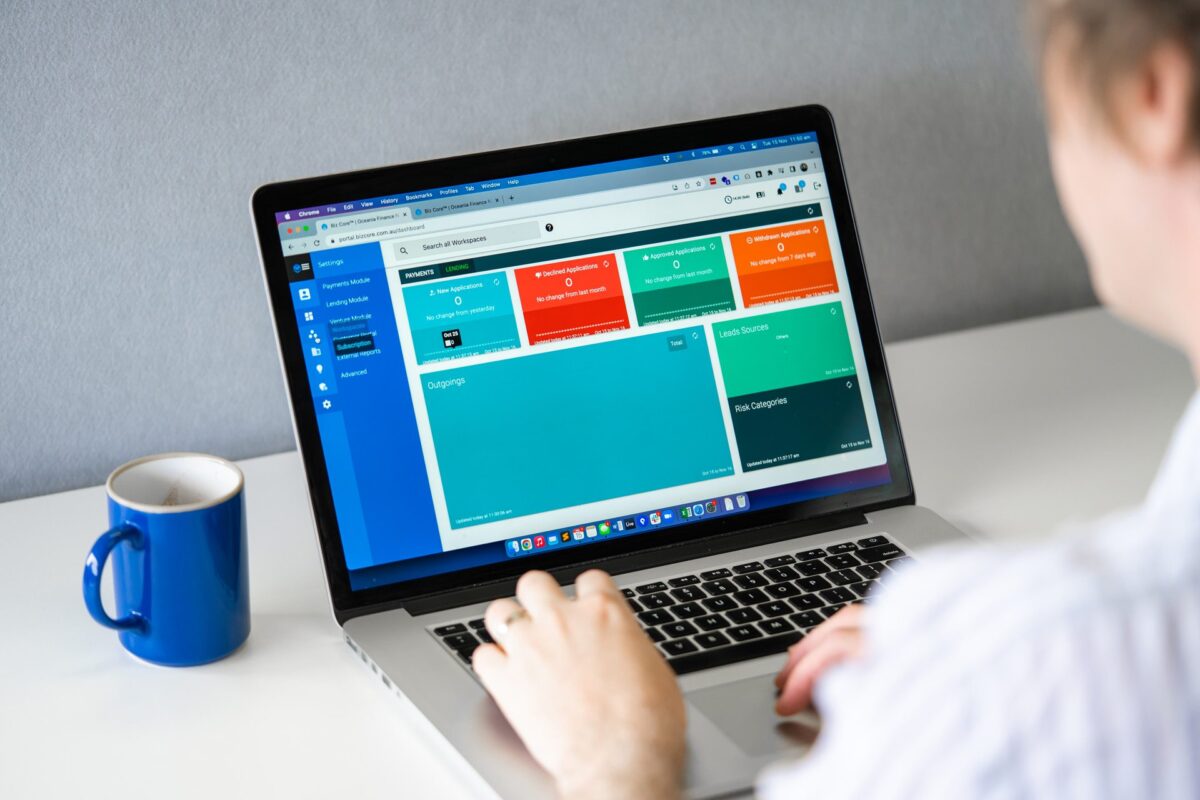

Loan Management Solutions for your finance business

Enquire nowWe’re here to help your business thrive. Implement smoother loan management processes and better customer service with Biz Core’s cloud-based loan management software.

Explore our business solutions

Find out how Biz Core’s LMS can facilitate growth, save you money, and give you time back.

Small to medium lenders

Find out more about our specialised loan servicing solution for small to medium lending businesses.

Brokers

Take your business to the next level with Biz Core’s loan origination solution for mortgage brokers and personal loan brokers.

Private Lenders

Built for lenders in the Australian financial industry, Biz Core is here to provide you with a complete loan servicing and processing solution.

Consumer Lending

Unlike generic platforms, Biz Core’s consumer lending software is adaptable and customisable, evolving alongside your business as it grows.

Why Use BizCore Online Loan Management Solution

Security

Your data is safeguarded using the multilayered Microsoft Azure Cloud Security. With built-in security controls and real-time global cybersecurity intelligence to rapidly identify and stop new threats.

Real-Time Control

Make live changes as you work. Real-time data to keep you in the know and in control.

Low Set Up Fees

Only pay for what you use. With low set-up fees and no monthly fees for features that you’ll never use. (credit back – first invoice is 99 once you reached that) as credit back.

Scalable & Flexible

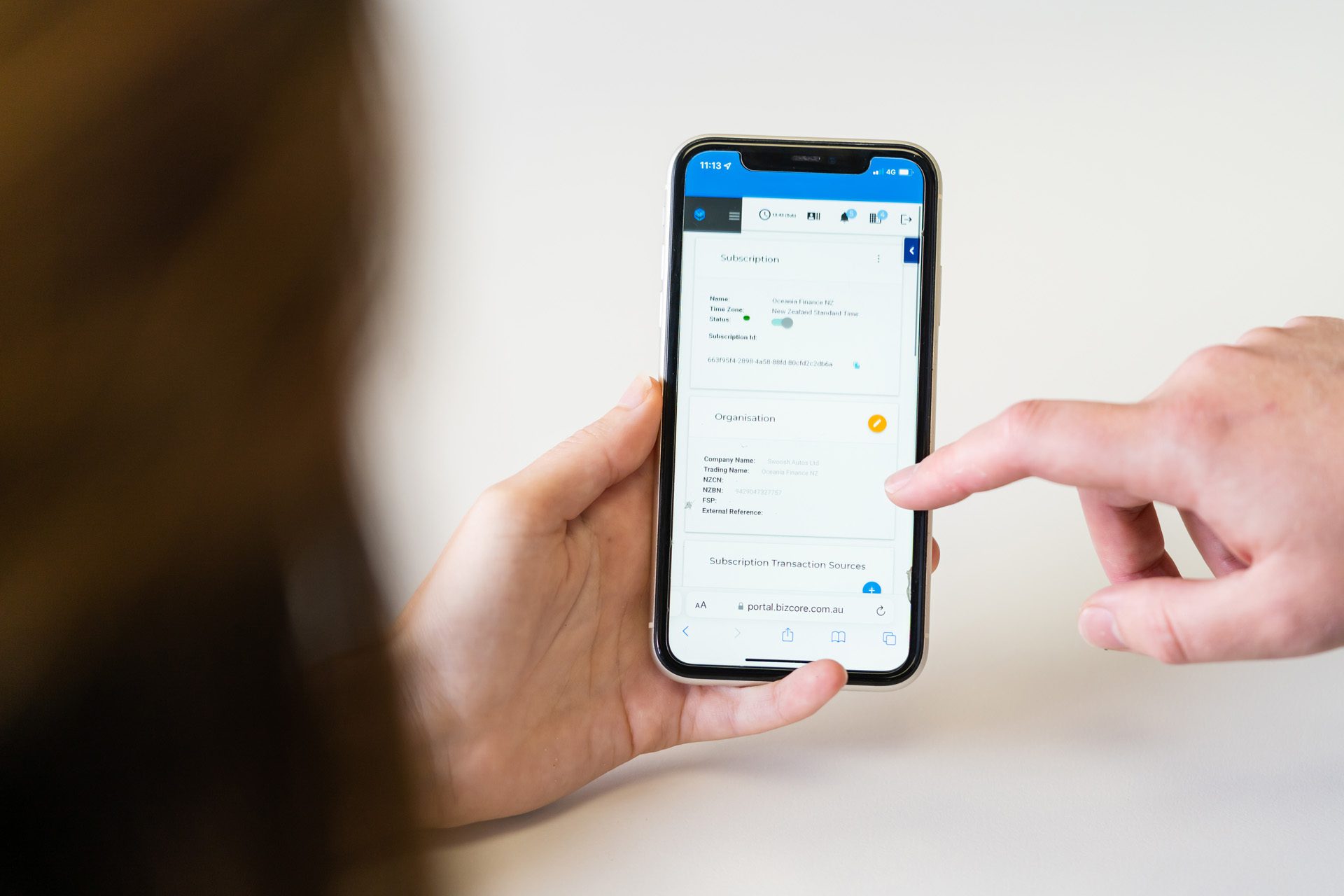

Our loan management systems are built to scale with you to meet your adapting business needs. So you know you’re secure for life.

Easy Integration

No need for 3rd party solutions, we have the tools to integrate all phases of the loan process into one simple management system.

PCI & DDC Compliant

Certified compliance for direct debit payment systems to keep your networks secure and cardholder data safe.

FAQs

What are the benefits of loan management software for small businesses?

There are many benefits to transitioning into an online LMS. It makes growing your business that much easier by starting you off on the right foot. And you will have the most secure, up-to-date software at your fingertips.

Your business will no longer be held back by the limitations of outdated software or time-consuming administrative work. Instead, you can streamline your lending service through automation and integration with third-party software. And your employees will be able to complete every phase of the loan life cycle from one system.

What is a direct payment system?

A direct payment system allows customers to transfer money from their bank account to yours. Using a cloud-based direct payment system, you will have the ability to manage all of your payment scheduling, collections, and processing online. And the ability to manage customer details.

Contact us today to find out how Biz Core’s direct debit system can simplify your payment and customer management.

How can my business take recurring payments online?

Recurring payment software, such as Biz Core, can help you take recurring payments online. The process usually includes:

-

- The customer elects to pay via recurring payments.

- They will then agree to the terms and conditions, the payment amount, the payment schedule and the end date.

- The customer will provide their payment information and consent for the business to securely store this information.

- Recurring payments will take place with the recurring payment software managing the transaction.

- Lastly, your customer will receive an invoice listing the payment details. You may also choose to send them a notification or reminder alerting them to the next date of payment.

Request a demo with our Biz Core experts today to see how we can save you time and help you forecast income.