Biz Core’s Complete Loan Management Software

Biz Core is a total lending solution that rolls the full loan lifecycle into a single online platform. A local product built with Australian and New Zealand requirements in mind for private lenders and direct lending services.

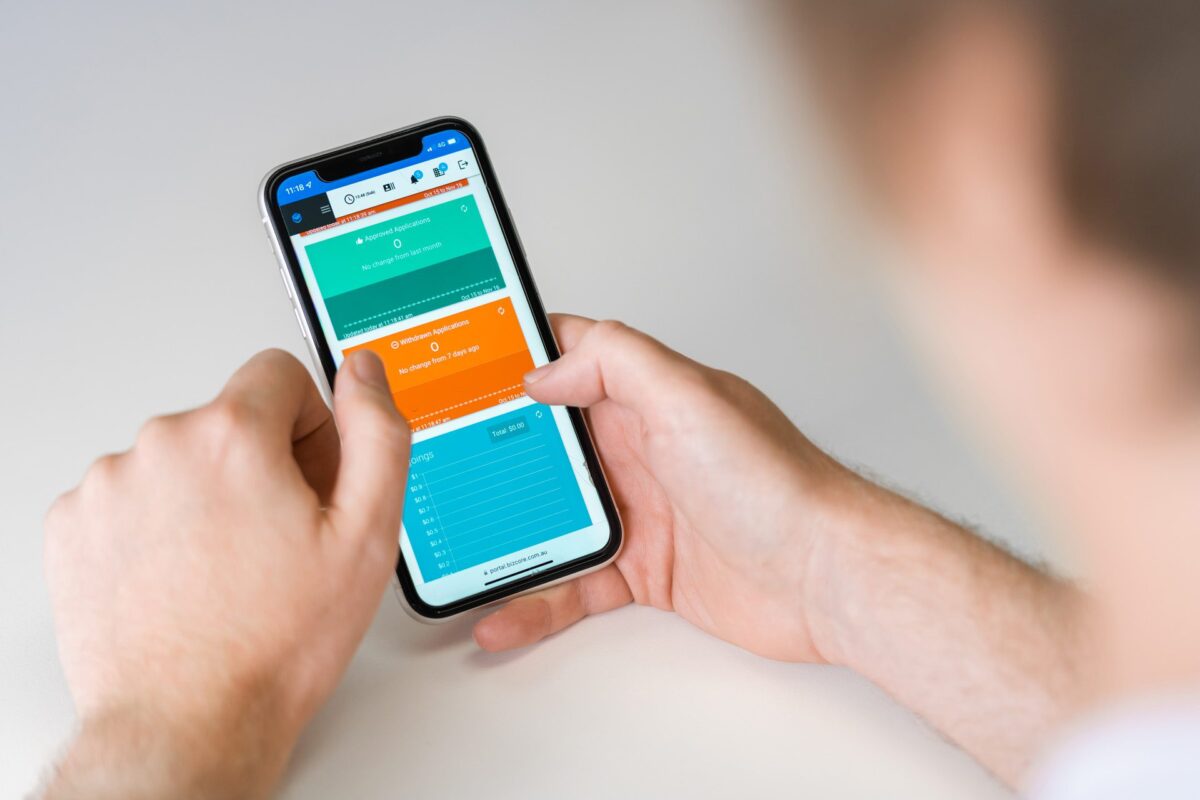

When you’re ready to take the next step to digitise your lending business, streamline your workflow, and increase productivity, we’re here to make it happen. Boost efficiency, process applications faster, and take control of your loan portfolio with a simple, intuitive, user-friendly lending system.

Get set up in a matter of weeks with premium loan servicing features rolled into a single affordable and user-friendly platform.

✔️Low set up costs ✔️Simple & Intuitive ✔️Local Aussie Support

Loan Management Software for Small to Medium Sized Lenders

A client-centred approach using end-to-end lending software that is built around your needs and the needs of your customers.

Biz Core is an adaptable and scalable Australian-based lending management solution that will help your business reach new heights, it’s easy to use and ready to be tailored to your specific needs. There are low set-up fees and our local team is here anytime you need help.

Loan Lifecycle

A complete end-to-end lending platform to support you through every stage of the digital lending journey, from lead generation through to origination and servicing. Learn more: Loan Lifecycle Management

Loan Book Management

Our simple and intuitive system makes loan book management easy. Single-point customer records, payment automation, and cash flow visualisation are just the beginning.

Learn more: Loan Book Management

Loan Servicing

Streamline the loan servicing process and keep things running smoothly. Our loan servicing features are built to save you time, money, and effort.

Learn more: Loan Servicing Solutions

Loan Origination

Get customers onboarded faster with fast processing, unlimited cloud storage, e-signatures, automation, and more.

Learn more: Lending Origination

What Makes Biz Core the Best Loan Management System?

We understand the unique requirements of local businesses and place them at the centre of our product development work. Why use a foreign product built to service different regulations, products, and customers? With Biz Core you have access to local support and a loan management platform built to service local Australian and New Zealand needs from the get-go.

Contact Us today to find out how we can help your business reach new heights.

Benefits of Using Biz Core’s Complete Loan Management Solution

Low Set-Up Fees

Low upfront costs. Only pay for what you use, with competitive set-up fees!

Security

Your data is safeguarded using multilayered Microsoft Azure Cloud Security. With built-in security controls and real-time global cybersecurity intelligence, potential threats are rapidly identified and stopped.

Easy Integration & Automation

Make your life easier with our robust 3rd party integration facilities. Key external functions like card payment processing and bank statements can be accessed from within the one centralised loan management system.

Real-Time Control & Lending Tools

Make live changes as you work. Real-time data and our suite of lending tools keep you in the know and in total control.

Scalable & Flexible

Our loan management software is built to scale as your business does. When you choose Biz Core, you’re secure for life.

Direct Debits & Payment Management

Loan repayments are easy to manage with our secure payment processing platform. You can accept recurring, automatic payments, track scheduled transactions, and handle failed payments from a single LMS.

100% Aussie Owned & Operated

Our digital lending solutions are all done locally to meet your uniquely Aussie business needs.

Check out our reviews to hear what our clients say

Our Partners

Get everything you need for your lending business in one user-friendly system.

Simplify the Lending Process Today today

Contact our friendly team of expert developers to find out how Biz Core can help your lending business.

Book a demo

Related articles

What is a Loan Lifecycle Management System?

Drowning in Excel spreadsheets? Losing business from multiple mistakes due to human error? Managing loans is a tough business, and it’s hard to keep track of all the applications, payments, and deb...

Read moreWhat is Loan Servicing Software?

What is loan servicing software? Managing a lending portfolio is a complex task, even for industry experts who can keep up with ever-changing regulations. The job only gets harder as your business ...

Read moreHow does lending software address the challenges in the loan origination process?

The right loan management software can help your business overcome numerous challenges in the loan origination process by:

Quickly identifying issues and resolving bottlenecks leading to faster loan turnaround times.

Keeping track of customer interactions.

Integrating software solutions.

Eliminating slow and messy paper applications in favour of fast, accurate, and secure digital applications.

What is the best software for end-to-end loan automation?

When looking for the best software for end-to-end loan automation, look out for features such as:

User-friendly platform for brokers

Robust suite of security features and data protection

Comprehensive reporting and analytic capabilities

Automated payment scheduling and processing

What is the best loan origination software for brokers?

The best loan origination software for brokers will offer a complete, all-in-one set of features that eases the lending process and facilitates positive customer experiences. When exploring your options, it’s important to ask the following questions:

Does it offer a user-friendly CRM system?

Does it offer seamless integration?

Does it feature comprehensive reporting and analytic capabilities?

Is there support available for any technical issues?

Is the system intuitive with an easy onboarding process?

Does it provide secure cloud storage?

By choosing the right lending software, you can strengthen your foundations and grow your business. Contact Biz Core today to find out how we can help your business succeed.